Decentralising your UK PLC isn’t about losing control; it’s about upgrading it from slow, manual approvals to fast, systemic guardrails.

- Hierarchical sign-offs are a major hidden cost, stifling the innovation your R&D budget is meant to foster.

- True autonomy is not chaos; it is granted through clear financial limits and delegating ownership of outcomes, not just tasks.

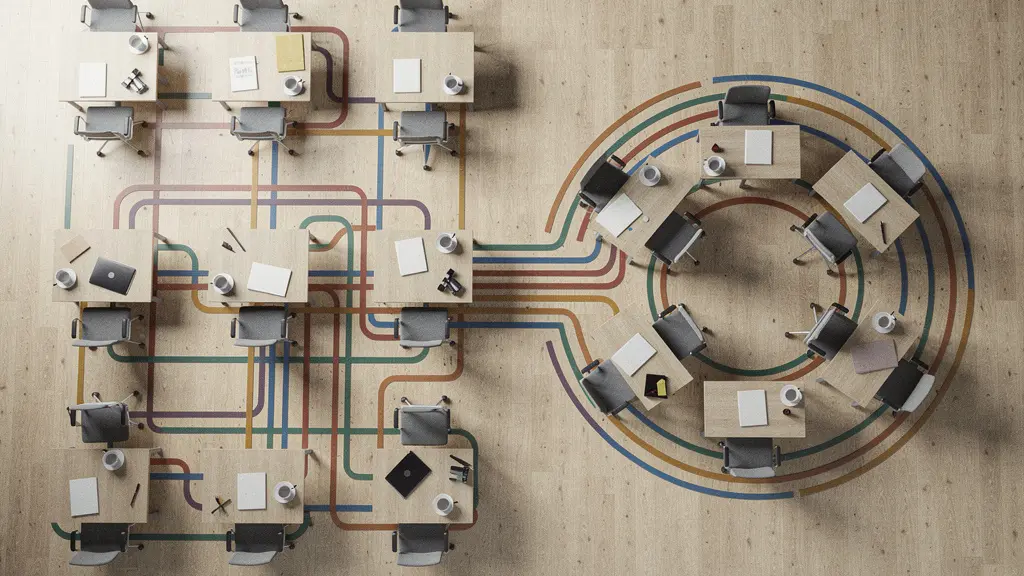

Recommendation: Begin not with a radical restructure, but by mapping your current “sign-off spaghetti” to identify the first, high-impact bottleneck to eliminate.

For the CEO of a Public Limited Company, the word ‘decentralisation’ often triggers an immune response. It conjures images of chaos, spiralling costs, and a complete loss of the very control required to meet fiduciary duties. Your organisation feels sluggish, outmanoeuvred by smaller, more agile competitors, yet the conventional wisdom to simply “empower employees” feels like a platitude-laden leap into the abyss. The core tension is clear: you need the speed and innovation of a startup but are constrained by the governance and scale of an established UK enterprise.

The standard solutions—more meetings, new communication software, another layer of project management—often fail because they treat the symptoms, not the disease. They don’t address the underlying structural friction that grinds progress to a halt. The problem isn’t a lack of talent or ambition within your teams; it’s a system designed for a bygone era of industrial predictability, where control flows exclusively from the top down and information trickles slowly back up.

But what if the solution wasn’t about relinquishing control, but fundamentally redesigning it? The key is to shift from a model of hierarchical permission-granting to one of distributed, principles-based authority. This is not a vague cultural initiative; it is an act of organisational engineering. It involves building robust financial guardrails, establishing radical clarity on decision-making rights, and creating systems that ensure information flows symmetrically, giving you visibility without making you the bottleneck. This guide provides a structural framework for decentralising authority within the realities of a UK PLC, transforming your organisation from a rigid hierarchy into a responsive, resilient network.

To navigate this complex transformation, we will deconstruct the challenge into its core components. This article provides a strategic roadmap, moving from the operational friction caused by management layers and sign-off processes to the high-level strategic drag of traditional board structures.

Summary: A CEO’s Guide to Redesigning Control for Agility

- Why Your Middle Management Layer Stifles Innovation from Below?

- How to Set Spending Limits That Empower Teams Without Risking Fraud?

- Matrix vs Flat Structure: Which Suit UK Remote-First Companies?

- The Delegation Mistake That Leaves Teams Too Scared to Act

- How to Ensure Information Flows Upwards When Authority Flows Downwards?

- Why Traditional Board Structures Cost UK Firms £500k+ Annually in Lost Opportunities?

- Why Your ‘Sign-Off’ Process Adds 4 Weeks to Every Launch?

- How to Cut Time-to-Market by 30% by Granting Team Autonomy?

Why Your Middle Management Layer Stifles Innovation from Below?

In many PLCs, middle management has morphed from a vital communication conduit into a “permafrost” layer. Trained in risk mitigation and process adherence, managers often become gatekeepers of resources and permission, inadvertently filtering out or slowing down the very innovations that frontline staff identify. This isn’t a failing of individuals but a systemic issue. When a manager’s primary role is to control and report, their incentive is to minimise variance, not to champion potentially disruptive ideas from below. This structural reality is a key reason why the average management scores in the UK lag behind leading nations, directly impacting innovation performance.

The strategic shift required is to redefine the manager’s role from controller to coach and enabler. Their new purpose is not to grant permission, but to build team capability, remove obstacles, and ensure alignment with strategic goals. A powerful UK example of this is Timpson’s “upside-down management” model. In their 2,000+ branches, frontline colleagues are trusted with a high degree of autonomy. They can settle customer complaints up to a value of £500 without seeking approval, adjust local pricing, and design their own store displays. This doesn’t create chaos; it creates ownership and rapid problem-solving at the point of customer contact.

Transforming this layer involves a conscious re-architecting of roles and incentives. Managers must be trained and rewarded for delegating, developing their people, and fostering an environment where experimentation is safe. Their success is no longer measured by the quietness of their department, but by the velocity and impact of their team’s output. This reorientation is the first crucial step in unblocking the innovation pipeline that is currently trapped at the operational level of your organisation.

How to Set Spending Limits That Empower Teams Without Risking Fraud?

The fear of runaway spending is perhaps the single greatest barrier to decentralisation in a PLC. The default control mechanism—requiring multiple sign-offs for even minor expenditures—is a direct cause of organisational sluggishness. It communicates a fundamental lack of trust and creates a culture of dependency. The irony is that these complex controls are often inefficient; the UK Government’s own compliance data shows that only 50% of contract and supplier reports meet the quality threshold on the first attempt, indicating that bureaucracy doesn’t guarantee quality.

The solution is not to eliminate financial controls but to make them smarter and more dynamic. This means moving from a system of universal, rigid thresholds to a framework of “Earned Autonomy.” This model, used by the UK Cabinet Office to manage public spending, grants greater authority and higher spending thresholds to departments and teams that consistently demonstrate strong governance and capability. It replaces a one-size-fits-all approach with a tiered system that rewards competence and reliability. Instead of treating every team as a potential risk, it empowers proven performers, freeing up senior leadership to focus on true strategic oversight rather than tactical approvals.

Implementing this requires establishing clear, transparent criteria for what constitutes “strong governance.” This framework allows teams to operate with significant financial freedom within predefined guardrails, making decisions at speed. It shifts the control from a person (a manager) to a system (the framework), providing both empowerment and auditable accountability. The table below, inspired by government best practice, illustrates how this can be structured.

| Spending Type | Standard Threshold | With Earned Autonomy |

|---|---|---|

| Commercial | Subject to Central approval | Higher thresholds for demonstrated compliance |

| Technology | Mandatory pipeline reporting | Greater flexibility for strong governance |

| Property | Central approval required | Delegated authority possible |

Matrix vs Flat Structure: Which Suit UK Remote-First Companies?

The debate between matrix and flat structures often presents a false dichotomy, especially for a large UK PLC navigating a remote-first or hybrid environment. A pure flat structure, while appealing in theory, can lead to chaos at scale, creating unclear reporting lines and decision-making paralysis. Conversely, a rigid matrix structure, with its dual reporting lines, can become a bureaucratic nightmare in a remote setting, leading to endless virtual meetings and conflicting priorities. For most PLCs, the optimal solution is neither extreme, but a “flatter” matrix that prioritises clarity and speed.

The key is to design a structure that supports asynchronous work and minimises the need for constant, real-time consensus. This means clarifying who owns which decisions and insulating teams from competing priorities. A flatter matrix might retain functional departments for expertise and career development (e.g., Engineering, Marketing) but deploy employees into long-term, cross-functional product or mission teams with a single, empowered leader who has end-to-end ownership.

In a UK remote-first context, this structure has distinct advantages. It provides the clarity needed to comply with employment regulations while offering the flexibility that attracts top talent. The emphasis on empowered, single-threaded teams reduces the “meeting tax” and respects employees’ focus time, a critical factor for productivity and well-being in a work-from-home model. The challenge is not to eliminate hierarchy entirely—an unrealistic goal for a PLC—but to ensure that the structure serves the flow of work, rather than hindering it. The goal is organisational clarity over structural purity.

The Delegation Mistake That Leaves Teams Too Scared to Act

Many leaders believe they are delegating when, in reality, they are merely assigning tasks. They hand off the “what” and the “how” but retain all authority, creating a dynamic where teams are responsible for execution but powerless to make meaningful decisions. This is the single most common delegation mistake, and it breeds a culture of fear and inaction. Teams become conditioned to wait for instructions, hesitant to take initiative for fear of overstepping invisible boundaries. This isn’t empowerment; it’s remote-control management, and it is the enemy of speed.

True decentralisation requires delegating outcome accountability, not task responsibility. This means defining the desired result (the “Key Result”), providing the team with the necessary budget and authority to achieve it, and then getting out of the way. The team owns the “how.” This requires a profound shift in mindset, supported by a clear framework that distinguishes between low-risk, reversible decisions (“two-way doors”) and high-risk, irreversible ones (“one-way doors”). Reversible decisions should require no sign-off, empowering teams to experiment and learn quickly.

To make this shift safe, it must be paired with a blameless post-mortem culture. When things go wrong—and they will—the focus must be on systemic learnings, not individual blame. This psychological safety is the bedrock upon which a team’s confidence to act is built. Without it, delegated authority is a hollow concept. The following checklist provides a framework for auditing and improving your own delegation practices.

Your Action Plan: Auditing Your Delegation Framework

- Delegate Outcomes, Not Tasks: Are teams given ownership of a Key Result with budget and authority, or just a list of tasks?

- Establish Decision Frameworks: Have you defined a ‘Two-Way Door’ vs ‘One-Way Door’ policy so teams know which decisions they can make autonomously?

- Foster a Blameless Culture: Does your post-mortem process focus on systemic learnings and process improvements rather than assigning individual blame?

- Implement Clear Ownership: Are key initiatives led by a “Single Threaded Leader” with end-to-end ownership, insulated from competing priorities?

- Review Authority Levels: Are financial and decision-making limits for teams reviewed and increased based on demonstrated performance (“Earned Autonomy”)?

How to Ensure Information Flows Upwards When Authority Flows Downwards?

A common executive fear is that decentralising authority means flying blind. If you’re not the one signing off on decisions, how do you maintain visibility of risks and progress? This concern is valid. Decentralisation fails catastrophically without a corresponding redesign of information flow. When authority flows down, information must flow up—not through cumbersome status reports and endless review meetings, but through lightweight, transparent systems.

The goal is to achieve information symmetry, where leaders have real-time access to the data they need without becoming a bottleneck. This requires moving away from narrative-based reporting and towards data-driven dashboards and automated alerts. The UK Cabinet Office’s approach to its evolving spend controls offers a valuable insight: they mandate “lightweight reporting mechanisms that capture material risks while avoiding bureaucracy recreation.” For a PLC, this could mean implementing mandatory but simple pipelines for all significant projects, capturing key metrics on progress, budget burn, and identified risks in a standardised, easily digestible format.

This approach is built on a principle of “trust but verify.” You trust the team to execute, but you verify progress through transparent data. As the UK Government model suggests, “Where organisations consistently meet or exceed required standards and demonstrate strong governance… they may earn greater autonomy.” This feedback loop is critical. Upward information flow is not about surveillance; it’s about providing the visibility that makes leaders feel safe enough to cede control. It’s the nervous system of a decentralised organisation, allowing the whole to sense and respond as one.

Why Traditional Board Structures Cost UK Firms £500k+ Annually in Lost Opportunities?

While operational friction is a significant drag on performance, the most profound costs often originate at the very top: the board. Traditional board structures, designed for quarterly oversight and annual strategic reviews, are fundamentally ill-suited to the pace of modern markets. Their approval processes for new ventures, significant tech investments, or market entries can introduce months of delay, turning a first-mover advantage into a “me-too” market entry. This isn’t a theoretical risk; it’s a direct and quantifiable loss of opportunity.

The UK is a world leader in research, with £55.6 billion spent on R&D by UK businesses in 2024. Yet, this scientific strength often fails to translate into economic value. The UK Innovation Report 2024 highlights this very problem, noting that “technologies developed in the UK are often commercialised and produce well-paid jobs elsewhere.” A key contributor to this “commercialisation gap” is slow and risk-averse governance. When a board requires a near-certain business case before approving an exploratory venture, it effectively shuts down the very innovation it claims to support. The £500k figure in the title is a conservative placeholder for the multi-million-pound opportunities lost when a single promising venture is either delayed into irrelevance or abandoned due to bureaucratic hurdles.

To counter this, boards must evolve from gatekeepers to enablers of a strategic portfolio of bets. This involves ring-fencing innovation budgets, delegating authority for smaller-scale experiments to executive teams, and focusing their own governance on the largest, “one-way door” decisions. Their role is to set the strategic direction and risk appetite, not to micromanage its execution. By failing to adapt, traditional boards are inadvertently costing shareholders vast sums in lost growth, a hidden tax on the future of the company.

Why Your ‘Sign-Off’ Process Adds 4 Weeks to Every Launch?

The “sign-off” is the most tangible manifestation of centralised control, and it is a silent killer of speed. Consider a typical product launch: marketing, legal, compliance, finance, and senior leadership must all approve. Each step introduces a queue, a context-switching delay, and a potential round of revisions. This complex web of dependencies, the “Sign-Off Spaghetti,” can easily add four weeks or more to any significant project. In a fast-moving market, a month is an eternity. This delay is a direct, measurable cost to the business in terms of lost revenue and market share.

The problem is often compounded by a misunderstanding of risk. In an attempt to de-risk a project, legal and compliance teams are often brought in at the end, leading to eleventh-hour roadblocks. An extreme example of institutional delay can be seen in regulatory environments; FCA enforcement investigations in 2023/24 took an average of 43 months from opening to closure. While not a direct parallel to a product launch, this figure illustrates the incredible inertia that can build up in complex, multi-stakeholder processes.

To cut this Gordian Knot, the approach to risk management must be inverted. Instead of using compliance as a final gate, involve them at the very beginning to help define a ‘safe operating sandbox.’ This upfront collaboration establishes the rules, constraints, and non-negotiables within which the project team can then operate with full autonomy. Paired with a “Two-Way Door” framework that allows reversible decisions to bypass multi-level approvals entirely, this approach transforms the sign-off process from a multi-week gauntlet into a simple check for adherence to pre-agreed principles. It’s about proactive risk-framing, not reactive gatekeeping.

Key Takeaways

- True decentralisation is not the absence of control, but its evolution from manual oversight to systemic, automated guardrails.

- The biggest mistake is delegating tasks instead of outcomes. Grant teams P&L-style ownership of their objectives.

- Speed is a function of trust. Build trust systemically through “Earned Autonomy” and “Blameless Post-Mortems,” not just through interpersonal relationships.

How to Cut Time-to-Market by 30% by Granting Team Autonomy?

The cumulative effect of redesigning control is a dramatic acceleration in time-to-market. A 30% reduction is not an optimistic fantasy; it is the logical outcome of removing the systemic delays baked into a traditional hierarchical structure. Each day saved by eliminating a sign-off, each week gained by empowering a team to make a reversible decision, and each month reclaimed from a stalled board approval process contributes to this velocity. Autonomy is not a cultural perk; it is a strategic lever for speed.

The relationship between autonomy and speed is direct and measurable. As teams move from a state of being micromanaged to operating as truly autonomous units, their ability to decide, execute, and iterate accelerates exponentially. They are no longer waiting in queues for permission. They are able to respond to market feedback and customer needs in days, not months. This progression transforms the organisation’s capacity for innovation and its resilience in the face of market shifts.

This journey from micromanagement to autonomy is not just structural; it’s deeply human. It requires a leadership that genuinely believes in the capabilities of its people. As James Timpson, a pioneer of this model in the UK, states:

A culture based on trust and kindness works when we recruit colleagues with an amazing personality

– James Timpson, Business-Sale.com Interview

Ultimately, decentralising authority is about building a faster, more intelligent, and more resilient organisation. It’s about trusting your teams not just to do the work, but to own the outcome. This final table summarises the clear business case for making this transformation.

| Autonomy Level | Decision Speed | Innovation Impact | Implementation Example |

|---|---|---|---|

| Micromanaged | Slowest | Minimal innovation | All decisions require approval |

| Managed | Moderate | Some innovation | Guidelines with oversight |

| Autonomous Teams | Fast | High innovation | Teams own outcomes fully |

The transition to a decentralised model is not a single event but a continuous process of strategic re-architecture. The next logical step is not to dismantle your company structure overnight, but to begin by auditing your existing delegation and approval processes to find the first, safest, and most impactful area to apply these principles.