True overhead reduction in 2025 isn’t about squeezing suppliers for pennies, but about structurally eliminating the hidden costs of inefficiency and vulnerability.

- Cheap materials often carry the highest Total Cost of Ownership (TCO) due to failure rates and reputational risk.

- Maverick spend and unmanaged utility contracts are silent budget killers that require immediate auditing.

Recommendation: Shift your strategy from ‘Just-in-Time’ to ‘Just-in-Case’ by conducting a full activity-based cost audit and consolidating logistics immediately.

For UK Procurement Directors, the current landscape is a minefield. Between post-Brexit friction, volatile energy price caps, and the lingering disruptions in the Red Sea, the pressure to cut costs is immense. However, the traditional lever of simply demanding lower unit prices from suppliers has broken. It is a strategy that now yields diminishing returns and dangerously exposes the supply chain to quality failure.

We often hear the standard advice: “renegotiate payment terms” or “diversify your supplier base”. While valid, these are hygiene factors, not strategic solutions. They do not address the root causes of margin erosion, such as the hidden costs of carbon-intensive logistics or the bleeding caused by decentralized purchasing habits. In the current UK economy, distinct from the global context due to our specific border and energy challenges, we must look deeper.

The real solution lies in a counter-intuitive approach: spending better to spend less. It involves recognising that resilience and quality are not expenses to be minimized, but assets that reduce total overheads. This article outlines a forensic approach to stripping out bad costs—waste, inefficiency, and risk—while fortifying the good costs that guarantee delivery.

We will examine how to restructure your procurement architecture, from the raw materials entering your factory to the energy powering it, ensuring every pound spent contributes directly to value.

The following analysis breaks down eight critical areas where overheads can be slashed through strategic structural changes rather than quality degradation.

Table of Contents: Strategies for Overhead Optimization

- Why Buying Cheap Materials Is Increasing Your Manufacturing Overheads?

- How to Consolidate Shipments to Combat Rising UK Fuel Surcharges?

- Nearshoring vs Offshoring: Which Reduces Total Overheads in 2024?

- The Unapproved Purchasing Habit That Bleeds 5% of Your Budget

- How to Conduct an Energy Audit to Slash Utility Bills by 15%?

- Why Your ‘Just-in-Time’ Model Is Failing in the Current UK Economy?

- How to Negotiate Utilities Contracts Before the Next UK Price Cap Rise?

- How to Calculate ‘Cost to Serve’ to Reveal Hidden Margin Killers?

Why Buying Cheap Materials Is Increasing Your Manufacturing Overheads?

The allure of the lowest unit price is the most dangerous trap in modern procurement. When inflation bites, the instinct is to switch to cheaper feedstock or components. However, in the manufacturing sector, there is a direct correlation between “cheap” inputs and expensive outcomes. Lower-grade materials frequently lead to higher rejection rates, increased machine wear, and production downtimes that dwarf the initial savings.

Consider the visual evidence of material failure. The image below illustrates the microscopic reality of subpar components under stress—fractures that lead to catastrophic operational failure.

Such failures are not merely operational inconveniences; they are financial haemorrhages. The cost of rework, warranty claims, and reputational damage accumulates rapidly. Data supports this concern: in a volatile market, 70% of manufacturers saw costs increase significantly, a pressure that often forces bad purchasing decisions. Yet, those who maintain material standards often weather the storm better by avoiding the hidden factory of rework.

Case Study: The High Cost of Unsustainable Production at Port Talbot

In January 2024, Tata Steel announced the closure of both blast furnaces at Port Talbot Steelworks, putting approximately 3,000 jobs at risk. The decision was partly driven by the need to transition toward more environmentally sustainable production methods. This case illustrates how reliance on lower-cost, carbon-intensive production processes eventually generates unsustainable overheads — regulatory, environmental, and reputational — that outweigh the apparent savings on materials and energy.

Therefore, the procurement function must pivot from “Price Variance” to “Yield Variance”. It is more profitable to pay 5% more for a material that processes 10% faster with zero defects than to save on the invoice and lose on the production line.

How to Consolidate Shipments to Combat Rising UK Fuel Surcharges?

Logistics overheads in the UK are being battered by a perfect storm of driver shortages, fuel duty uncertainty, and green levies. The traditional model of sending out half-empty lorries to meet arbitrary deadlines is no longer financially viable. The solution lies in aggressive consolidation and the adoption of hub-and-spoke models.

Consolidation is not just about waiting until a truck is full; it is about architectural efficiency. By utilising pallet networks, businesses can share transportation space, drastically reducing the cost per unit. The efficiency gains are measurable: 73% average vehicle fill using hub-and-spoke consolidation is achievable, compared to the industry average of just 51%. This differential represents a massive saving in fuel surcharges and carbon taxes.

To achieve this, Procurement Directors must collaborate closely with Logistics Managers to align purchasing schedules with shipping windows. It requires a shift from “ASAP” delivery to “Optimised” delivery. This might mean ordering larger quantities less frequently or coordinating with suppliers to utilise double-deck trailers. The reduction in the number of drops and the maximisation of cubic capacity directly attacks the transport overhead line item.

Furthermore, consolidation improves inbound visibility. Fewer, larger deliveries mean less time spent on the loading dock receiving goods and less administrative burden processing delivery notes. It is a structural fix that lowers the Total Cost of Ownership.

Nearshoring vs Offshoring: Which Reduces Total Overheads in 2024?

The debate between nearshoring and offshoring has moved beyond simple labour arbitrage. In 2024, the calculation involves lead time stability, working capital requirements, and carbon border mechanisms. While the Far East still offers lower unit labour costs, the “Total Landed Cost” often tells a different story for UK businesses.

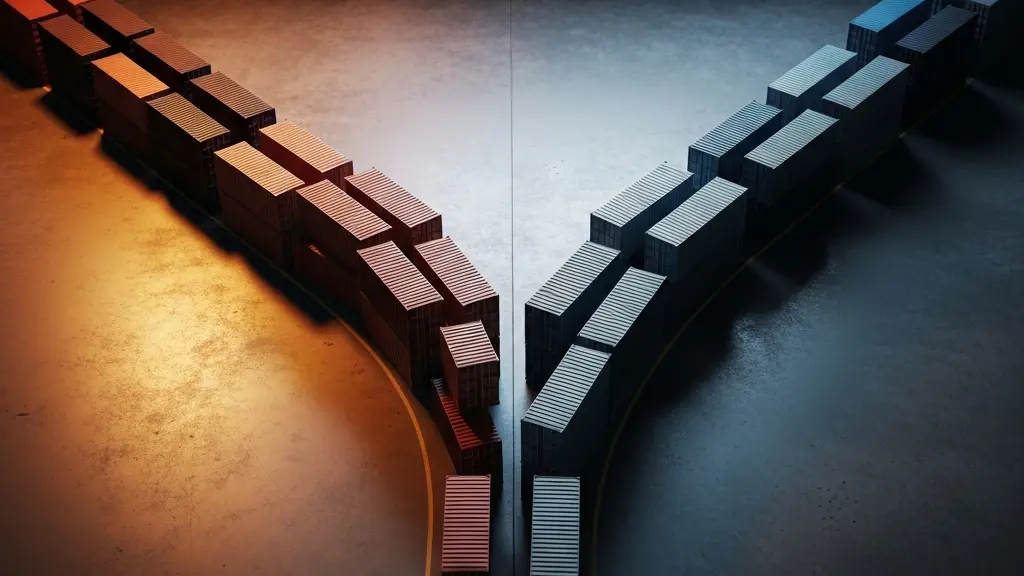

Visualising the supply chain layout helps to understand the strategic trade-off. The image below depicts the divergence between a responsive, proximate supply chain and a distant, risk-prone one.

The Savills 2024 Nearshoring Index highlights a shift in preference. Countries like Poland and the Czech Republic are becoming critical hubs. In fact, the top 5 nearshoring destinations globally now include Portugal and the Czech Republic, offering a balance of cost and EU proximity that China cannot match.

The following comparison breaks down the specific overhead factors that influence this decision for UK importers.

As demonstrated by the Savills 2024 analysis:

| Factor | Nearshoring (e.g. Poland, Turkey, Czech Republic) | Offshoring (e.g. China, India, Vietnam) |

|---|---|---|

| Labour Cost Savings vs UK | 30–40% lower | 50–70% lower |

| Shipping Lead Time to UK | 2–5 days (road/short-sea) | 25–45 days (deep-sea freight) |

| Time-Zone Overlap with UK | High (0–3 hours difference) | Low (5–8 hours difference) |

| Post-Brexit Tariff Access | Preferential via UK-EU TCA / bilateral FTAs | MFN tariffs apply unless specific FTA exists |

| UK CBAM Exposure (from 2027) | Low (EU-aligned carbon pricing) | High (carbon-intensive manufacturing) |

| Quality Control Travel Cost | £200–500 per visit (short-haul flights) | £1,500–3,000+ per visit (long-haul) |

| IP Protection Regime | Strong (EU/WIPO aligned) | Variable (jurisdiction-dependent) |

| Pipeline Inventory Carrying Cost | Lower (shorter lead times reduce working capital) | Higher (longer transit = more capital tied up at BoE base rates) |

| ESG/Modern Slavery Audit Burden | Moderate (aligned regulatory frameworks) | High (complex due-diligence requirements) |

| Supply Chain Resilience | High (geographic proximity, fewer disruption points) | Lower (exposed to geopolitical, climate, and routing risks) |

Ultimately, nearshoring reduces the “cost of inventory in transit” and the risk of stockouts. In an era of high interest rates, holding stock on a ship for 45 days is an overhead that finance directors can no longer ignore.

The Unapproved Purchasing Habit That Bleeds 5% of Your Budget

Maverick spend—purchasing goods or services outside of agreed contracts and established procedures—is a silent killer of procurement performance. It fragments volume, rendering negotiated discounts useless, and often exposes the company to unvetted contractual risks. In many organisations, it is not malice but convenience that drives this behaviour.

The scale of the problem is often underestimated. Research indicates that up to 80% of all invoices in large organisations can be classified as maverick purchases. This represents a colossal leakage of value, estimated at up to 16% of negotiated savings. When procurement negotiates a rate, but the business buys elsewhere, the overhead reduction strategy exists only on paper.

Eliminating this requires a dual approach: technological enforcement and cultural education. It involves making the compliant path the path of least resistance. If the internal catalogue is harder to use than Amazon, maverick spend will persist. The goal is to funnel 100% of spend through approved channels to regain visibility and control.

Action Plan to Eliminate Maverick Spend: Your Protocol

- Points of contact: Conduct a spend analysis to classify all expenditures by supplier and identify off-contract leaks.

- Collecte: Establish a strict pre-approved supplier catalogue with pre-negotiated terms (like the CCS model).

- Cohérence: Simplify the Procure-to-Pay (P2P) process to enable one-click compliant ordering, removing the friction that causes bypassing.

- Mémorabilité/émotion: Deploy guided buying technology to automatically route purchases and flag non-compliance immediately.

- Plan d’intégration: Continuously monitor on-contract vs off-contract ratios and report these to department heads to enforce accountability.

How to Conduct an Energy Audit to Slash Utility Bills by 15%?

Energy is no longer a fixed overhead; it is a variable cost that must be aggressively managed. For UK manufacturers, the energy crisis has been an existential threat. Data reveals that 60% of British manufacturers are at risk due to soaring energy bills. Yet, complacency remains rife. Many firms treat energy bills as inevitable rather than negotiable.

A strategic energy audit goes beyond checking the meter. It involves analysing the “load profile” of your facility. Are you running high-consumption machinery during peak tariff hours? Are there phantom loads drawing power when the factory is closed? Integrating findings from compliance schemes like ESOS (Energy Savings Opportunity Scheme) is crucial. Too often, these audits are filed away for compliance rather than used as a roadmap for cost reduction.

Furthermore, the audit should extend to the procurement of energy itself. Auto-renewing contracts without benchmarking against the wholesale market is a failure of fiduciary duty. By actively managing the timing of contract renewals and exploring flexible purchasing baskets, procurement can lock in rates during market dips rather than panic-buying at peaks.

Why Your ‘Just-in-Time’ Model Is Failing in the Current UK Economy?

For decades, “Just-in-Time” (JIT) was the gold standard for reducing inventory overheads. The logic was simple: inventory is cash tied up, so minimize it. However, the UK’s current economic reality has exposed the fragility of this model. JIT relies on predictable borders and frictionless transport—two things currently in short supply.

When supply chains fracture, JIT becomes “Just-Too-Late”. The cost of a stopped production line due to a missing part far outweighs the cost of holding safety stock. Recent surveys underscore the severity of the situation; output balance fell sharply to -1% in early 2025, signalling that manufacturers are struggling to maintain consistent production flows amidst disruptions.

The strategic shift is towards “Just-in-Case” (JIC) for critical components. This doesn’t mean hoarding everything, but rather segmenting inventory based on risk and impact. High-risk, low-cost items should have deep buffers. This resilience reduces the overheads associated with expedited freight (panic shipping) and overtime payments to catch up on lost production schedules. In today’s volatility, availability is the new efficiency.

How to Negotiate Utilities Contracts Before the Next UK Price Cap Rise?

Negotiating utility contracts in the UK requires timing and intelligence. The days of fixed-rate, long-term stability are largely gone; the market is dynamic. Waiting for the renewal notice to arrive is a strategy for overpayment. Procurement Directors need to track wholesale indicators like the ICE UK Natural Gas futures to time their entry into the market.

A critical error is ignoring the non-commodity costs. While the wholesale price gets the headlines, network charges and government levies make up a significant portion of the bill. Understanding these can open doors to “pass-through” contracts where you can manage your consumption to avoid peak network charges (Triads or their replacements), significantly lowering the average unit rate.

Additionally, the negotiation must address the structural obstacles to growth. As noted in forward-looking surveys, nearly two-thirds of manufacturers identify energy costs as a primary barrier. This necessitates looking at Power Purchase Agreements (PPAs) or on-site generation (solar PV) not just as green initiatives, but as hedging instruments against future grid price volatility.

Key Takeaways

- Do not compromise on material quality; the cost of failure exceeds the saving.

- Use pallet networks to consolidate freight and fill vehicles to 70%+ capacity.

- Eliminate maverick spend to recapture up to 16% of lost value.

How to Calculate ‘Cost to Serve’ to Reveal Hidden Margin Killers?

Many businesses operate under the illusion that all revenue is good revenue. They chase sales volume without understanding the specific overheads required to service different channels or customers. This is where “Cost to Serve” (CTS) analysis becomes a powerful procurement and finance tool.

CTS reveals the hidden truth: some customers are unprofitable. If a client requires frequent small deliveries, bespoke packaging, and extended payment terms, the overheads allocated to them may consume the entire gross margin. We know that an estimated 50% to 75% of business costs are directly influenced by supply chain decisions, yet these are often treated as a generic “peanut butter” spread across all accounts.

By implementing Activity-Based Costing (ABC), you can assign specific logistics, warehousing, and administrative costs to specific clients. This granular visibility allows you to renegotiate terms with high-cost customers—forcing them to order in bulk, accept standard packaging, or pay a surcharge. It transforms procurement from a cost centre into a margin protector.

Start your Activity-Based Costing audit today to identify your unprofitable channels and renegotiate terms for immediate margin improvement.

Frequently Asked Questions on Supply Chain Overheads

How is the Ofgem price cap calculated and when does it change?

The Ofgem price cap is calculated quarterly using wholesale energy futures prices (ICE UK Natural Gas, EEX Power UK baseload), network use-of-system charges, and policy cost levies. Businesses can monitor these same publicly available inputs to anticipate the cap’s direction 3–6 months ahead and time contract renewals strategically.

What are hidden TPI (Third-Party Intermediary) commissions in UK business energy contracts?

Many UK business energy brokers embed undisclosed commissions of 1–3p/kWh into contract rates. To verify, request a ‘letter of authority’ breakdown from your broker, or bypass intermediaries by approaching suppliers directly or selecting brokers from Ofgem’s voluntary TPI Code of Practice signatory list.

Can mid-sized UK businesses access Power Purchase Agreements (PPAs)?

Yes — aggregated or ‘sleeved’ PPA structures, offered through intermediaries, pool demand from multiple mid-sized buyers to reach the volume thresholds that unlock 10–15 year fixed-price renewable energy contracts at rates currently below wholesale forward curves.